Early moves by insurers suggest another round of price hikes and limited choices will greet insurance shoppers around the country when they begin searching for next year’s coverage on the public markets established by the Affordable Care Act.

Insurance companies still are making decisions about whether to offer coverage for individuals next year on these markets, and price-increase requests are only starting to be revealed by state regulators.

But in recent weeks, big insurers such as Aetna and Humana have dropped out of markets or are saying they aren’t ready to commit.

And regulators in Virginia and Maryland have reported early price-hike requests ranging from just under 10 percent to more than 50 percent.

Increases such as that probably will be seen in other states as insurers set prices to account for uncertain support from a federal government led by a new president who wants to scrap and replace the law, said Sabrina Corlette, a research professor at Georgetown Health Policy Institute.

“For the consumer, they’re going to see big rate hikes,” Corlette said.

Prices for this type of insurance already are being affected by evaporating competition.

With the latest departures, more than 40 percent of U.S. counties would have only one insurer selling coverage on their marketplaces for next year, according to data compiled by The Associated Press and the consulting firm Avalere. That assumes no other insurers leave and none step in by the time customers start shopping for coverage in the fall.

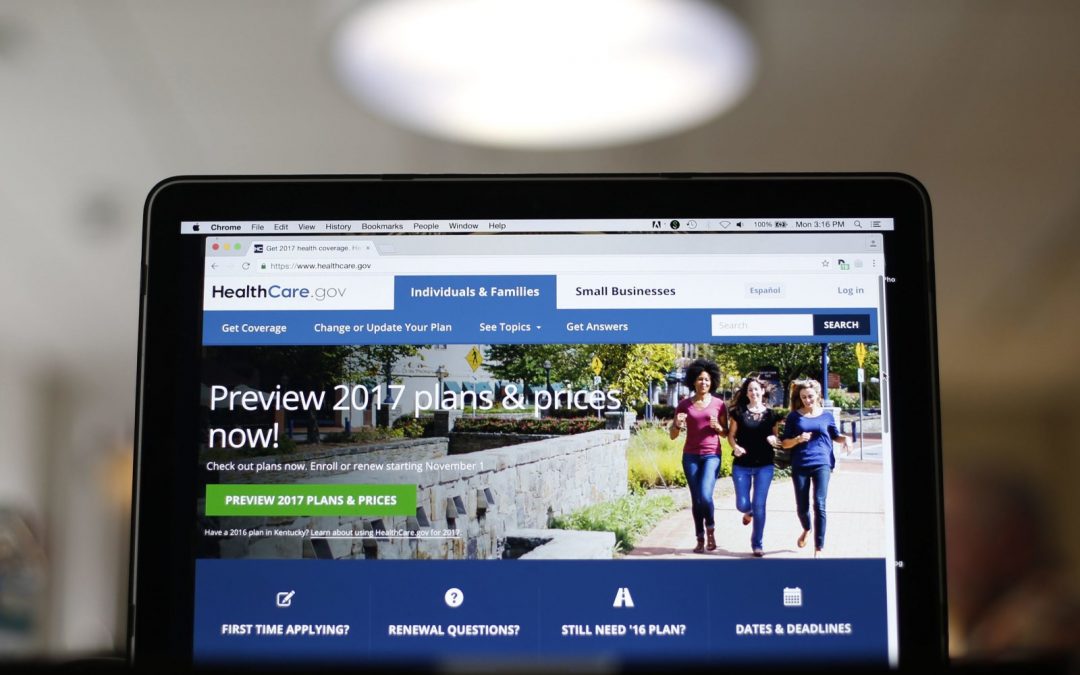

These state-based marketplaces, known as exchanges, were established by the Affordable Care Act as a place for customers to compare prices and buy coverage, often with help from income-based tax credits. They provided coverage for about 12 million people this year.

The idea was competition for customers would keep prices low. But insurers faced big losses in some markets, and they got less financial support from the government than expected. They’ve been raising prices and pulling out of some markets in response.

When insurers leave, prices rise. Insurers face less pressure to drive down prices to attract customers, and they have to raise rates because they must cover all the sick patients who apply.

The median coverage price this year for one typical plan was about 67 percent higher in marketplaces with one insurer compared to those that had six or more, according to a study by the not-for-profit Urban Institute. Those plans are used as a benchmark to calculate the tax credits that help people buy coverage.

Insurers also worry about the uncertain future of the Affordable Care Act. Insurers are concerned about the fate of two provisions that keep the market working: a government subsidy that makes coverage more affordable and a mandate that all people get insurance or pay a fine.

“Everything might be worse everywhere,” said Katherine Hempstead, a senior adviser with the Robert Wood Johnson Foundation, which studies the Obama-era health system and health care issues.

The nation’s third-largest insurer, Aetna, said Wednesday that it will completely leave the exchanges for 2018 after projecting a $200 million loss for this year. The insurer once covered more than 800,000 people through that marketplace, but it says steep losses have forced it to rapidly scale back. It sold coverage in four states for 2017, down from 15 the previous year.

Aetna joins Humana, which said earlier this year that it would abandon selling that kind of coverage, a decision that temporarily left 16 Tennessee counties with no individual Affordable Care Act options for 2018.

Insurers can decide to expand into new markets. For example, BlueCross BlueShield of Tennessee recently said it would serve those abandoned 16 Tennessee counties, but health policy experts do not expect it to happen very often because it is so expensive to launch coverage into new markets, especially at a time when the federal rules are in flux.

Some customers will be shielded from these price hikes by tax credits based on their income, but there are millions of customers who buy individual coverage without government help.

Customers won’t know for several more months for sure what their options are for next year. For now, eight states appear to be down to one insurer: Alaska, Alabama, Delaware, Missouri, Nebraska, Oklahoma, South Carolina and Wyoming.

Shoppers in Iowa also may be stuck with limited or no choices next year. Aetna is leaving that market, too. Wellmark Blue Cross and Blue Shield also said it will leave that state’s individual market after only a year on it. Another insurer, Medica, said earlier this month that its “ability to stay in the Iowa insurance market in any capacity is in question at this point.”